DCE Launches Soybean Internationalised Products

Dalian Commodity Exchange is one of the five derivatives exchanges in China regulated by CSRC, the exchange is ranked 9th by FUA in 2021 by annual trading volume, and the exchange currently has 21 futures and 11 options. Of these futures, 11 products are available to Overseas traders, including the recently launched Soybean No 1, Soybean No 2, Soybean Meal, and Soybean Oil futures. Alternatively, QFII licensed traders can access 14 products in total.

The exchange is reputable for various advantages such as being the home of the most liquid futures of agricultural products including soybean meal futures, soybean oil futures, palm oil futures, and iron ore futures.

This article will feature exclusive research from the “Industry walkthrough DCE webinar” to complement existing information.

Dalian Commodity Exchange Trading Information

Regarding the trading accounts, each client can only have one client number in DCE but may open various accounts at different futures company members or overseas intermediaries.

The digits in the account follow a fixed format: The first 4 digits are the member number, and the last 8 digits are the client number.

Regardless of which brokerage a client trades with the last 8 digits of the account will always be the same, however, the first 4 digits are subject to change.

Under DCE’s regulations as well as the CSRC’s approval, the account opening institutions including the member or overseas intermediaries will be responsible for checking trader eligibility of overseas clients that wish to trade under the QFII scheme. Some aspects that will be considered include knowledge of derivatives, the client’s current available funds, credit records, and experience.

Why Trade Soybean Futures?

Aspects of soybean futures have been covered in prior posts, however, this article will provide the statistics and fundamentals.

Soybean

Currently, the global soybean output is more than 360 MMT (Million Metric Tonnes), while the global trading volume continues to hit 170 MMT (Million Metric Tonnes).

Much of the output of soybean are generated by the biggest exporters, which are China, Brazil, the US, and Argentina. On the other hand, the biggest importer of these soybean products is China, the country imports around 100 MMT, approximately 60% of the country’s soybean, followed by Brazil and the US.

NON-GMO Soybean

Non-GMO Soybeans are soybean products that do not contain genetically altered materials, which makes them suitable for human consumption. It occupies a smaller market global output of 50 MMT, and is mainly produced by China, India, the US, Russia, and Ukraine. These countries contribute to more than 80% of the global output.

For Non-GMO soybeans, the EU is the biggest importer, with an import volume of above 2 MMT.

Correspondingly, China remains the largest producer and consumer of non-GMO soybean meal and soybean oil, but these too are for domestic consumption and not cross-border trading.

Soybean Meal Output: 68.9 MMT (28%): Soybean Meal Consumption 68.5 MMT (28%) – 2021

Soybean Oil Output: 16 MMT (26%), Soybean Oil Consumption 16.5 MMT (28%) – 2021

While non-GMO soybeans are mainly for domestic consumption and not cross-border trading, the trading volume for non-GMOs is around 10 MMT and the significant involvement of China makes it feasible for trading.

Soybean Trading Demographics and Pricing

Dalian Commodity Exchange provides the most liquid soybean meal futures worldwide both by volume and tonnage. Over 65% of traders that trade soybean-related futures are corporate clients, and the daily open interest for the soybean meal futures currently exceeds 2.5 million lots,25 MMT.

Alternatively, 90% of middle-sized oil and oil seeds enterprise also take part in the DCE futures market.

As of date, over 70% of soybean meal physical trades and over 40% of soybean physical trades in China are using DCE as the pricing benchmark. The benchmarks largely facilitaty hedging and risk mitigation for industrial participants.

Physical Settlements

Upon settlement, EFP, one-off delivery, and rolling delivery are available delivery methods for market participants. However, both QFII traders and individuals are not allowed to take part in physical delivery

Additionally, any entity clients that cannot receive or issue VAT invoices are prohibited from taking part in the physical delivery of No.1 Soybean Futures, No.2 Soybean Futures, Soybean meal, and oil.

Soybean Cross-Arbitrage

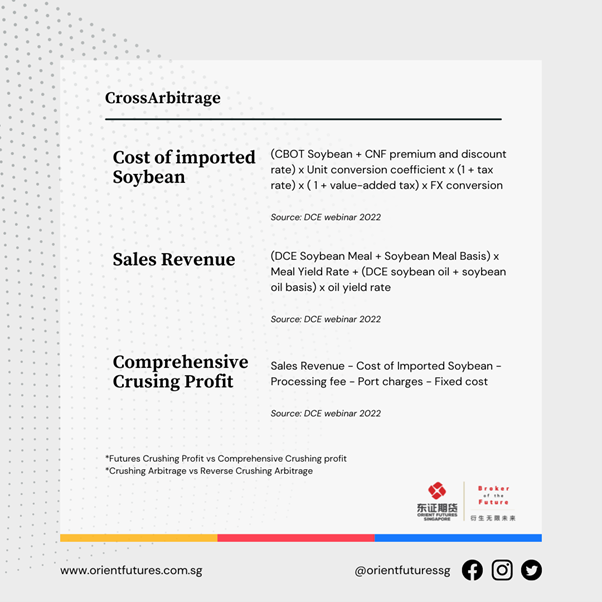

To calculate the Comprehensive Crush Profit, the formula is as follows:

The above formula is used to calculate the profits for the crushing arbitrage and reverse crushing arbitrage for specific reasons:

If the calculations suggest a poor crush margin, it suggests that the volume of imported soybeans has fallen and there is an undersupply of soybean oil and meal. This adversely increases the price of soybean oil and meal.

If the calculations suggest an improved crush margin, the number of imported soybeans will rise, this causes an oversupply of soybean oil and meal. This decreases the price of soybean oil and meal. Eventually, when crush margins fall back to a low, the process is repeated.

Therefore, it is important to track the changes in crush margins to execute the correct arbitrage strategy based on existing conditions.

As an example, it was recorded that the margins from October to September fell over 10%, therefore it was not feasible to trade this spread based on historical spreads.

It is also important to note that for every unit of soybean crushed, about 20% of soybean oil and 80% of soybean meal would be produced. The Oil to Meal ratios may diverge extensively, and when that happens there will be a trend of strong oil and weak meal or strong meal and weak oil.

Some of the Arbitrage combinations suggested include Soybean meal to Rapeseed Meal as they are both protein-feed ingredients. In this combination, the difference in supply between the two must be considered.

Another combination could be the Soybean Oil to Palm Olein combination as both are important edible vegetable oils. In this combination, the difference in supply, as well as industrial demand from overseas, must be considered.

Start Trading with Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG).

We provide premium customer service at an affordable cost to all our clients. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.